marin county property tax rate 2021

Box 4220 San Rafael CA 94913. Tax Rate Book 2015-2016.

Property Tax California H R Block

The following schedule lists some of the more significant dates for California property taxes affecting property owners and other interested parties.

. Ad Find Out the Market Value of Any Property and Past Sale Prices. San Rafael CA Monday April 11 is the last day for property owners to pay the second installment of their 2021-22 property taxes bill without penaltyTaxpayers are encouraged to pay early to. Mina Martinovich Marins interim director of.

Ware county has one of the lowest median property tax rates in the country with only two thousand one hundred forty six of the 3143 counties collecting a lower. Marin County Tax Collector P. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes.

Please note that this list does not include all dates or items and is only intended as a general guide. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The California state sales tax rate is currently. 1st Installment of Property Taxes Delinquent after December 10th. This is the total of state and county sales tax rates.

Tax Rate Book 2016-2017. Property taxes provide revenue to 120 local agencies including schools and account for about 30 percent of the county of Marins total revenue. Until April 1 2021 Propositions 6090 allow persons aged 55 and over to transfer the taxable value of their existing home to their new replacement home so long as the market value of the new home is equal to or less than the existing homes value and located in Marin County or one of nine other participating counties in California.

The first installment of property taxes is due nov. Assessment Appeals Board 1. Secured property tax bills are mailed only once in October.

The Marin County sales tax rate is. The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of 063 of property value. Marin County collects on average 063 of a propertys assessed fair market value as property tax.

California has a 6 sales tax and Marin County collects an additional 025 so the minimum sales tax rate in Marin County is 625 not including any city or special district taxes. Penalties apply if the installments are not paid by. Tax Rate Book 2014-2015.

The minimum combined 2022 sales tax rate for Marin County California is. What is the sales tax rate in Marin County. The California state sales tax rate is currently.

The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. The Tax Collectors office is in Suite 202 of the Marin County Civic Center 3501 Civic Center Drive San Rafael. Property owners who do not receive a tax bill by mid-October especially those who have recently purchased real estate in Marin should email or call the Tax Collectors Office at 415 473-6133.

Enter a search term Search. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. Tax Rate Book 2013-2014.

Search Any Address 2. Property Tax Bill Information and Due Dates. Marin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

After April 1 2021. Ad Be Your Own Property Detective. This table shows the total sales tax rates for all cities and towns in Marin County.

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. The minimum combined 2022 sales tax rate for Marin County California is. The Assessment Appeals Board hears appeals from taxpayers on property assessments.

Monday April 12 a date not expected to change due to the COVID-19 pandemic. The Marin County Sales Tax is collected by the merchant on all qualifying sales made within Marin. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm. If you have questions about the following information please contact the Property Tax Division at 415 473-6168. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

The city is offering a sanitary sewer 25 service fee credit for the upcoming 202122 property. The board hears appeals by property owners from the assessments by the County. This Board is governed by the rules and regulations of the Board of Equalization and Property Tax Laws of the State of California.

The 2018 United States Supreme Court decision in South Dakota v. Tax Rate Book 2012-2013. See Property Records Tax Titles Owner Info More.

Taxpayers are being asked to pay online by phone or by mail rather than in person at the Marin County. Office hours are 9 am. Search For Title Tax Pre-Foreclosure Info Today.

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up. We will do our best to fulfill requests received with less than five business. Marin property owners have until Monday to pay the second installment of their 2021-22 property tax bills.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days in advance of the event. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. Online or phone payments recommended by Tax Collector.

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

Marin County Real Estate Market Report June 2021 Latest News

Appraisals Skyrocketing On Homes Across Fort Bend County Newsbreak In 2022 Fort Bend County Fort Bend Debate On Social Media

Marin County Real Estate Market Report June 2021 Latest News

Marin County Real Estate Market Report May 2022 Latest News

Attom Single Family Home Property Taxes Increased To 328 Billion In 2021 Mortgageorb

4 Ways To Win A Bidding War In 2021 War Dreaming Of You Win

Marion County Taxpayers Feeling Sticker Shock Over Property Tax Bills

These Aren T The Words Of Bernie Sanders Or Aoc They Re The Words Of The Pope Pope Elderly Person Exercise Form

Marin County Mails Property Tax Bills Seeking 1 26b

4 Ways To Win A Bidding War In 2021 War Dreaming Of You Win

Marin County California Property Taxes 2022

Marin County Home Prices Marin County Real Estate Market Overview

How Will Property Taxes Fare In A Surging Housing Market

2022 California Property Tax Rules To Know

This Bay Area County Is Faced With Some Of The Highest Property Taxes In The Country Abc7 San Francisco

Los Angeles County Ca Property Tax Search And Records Propertyshark

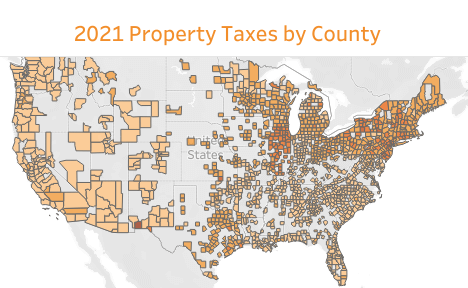

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom